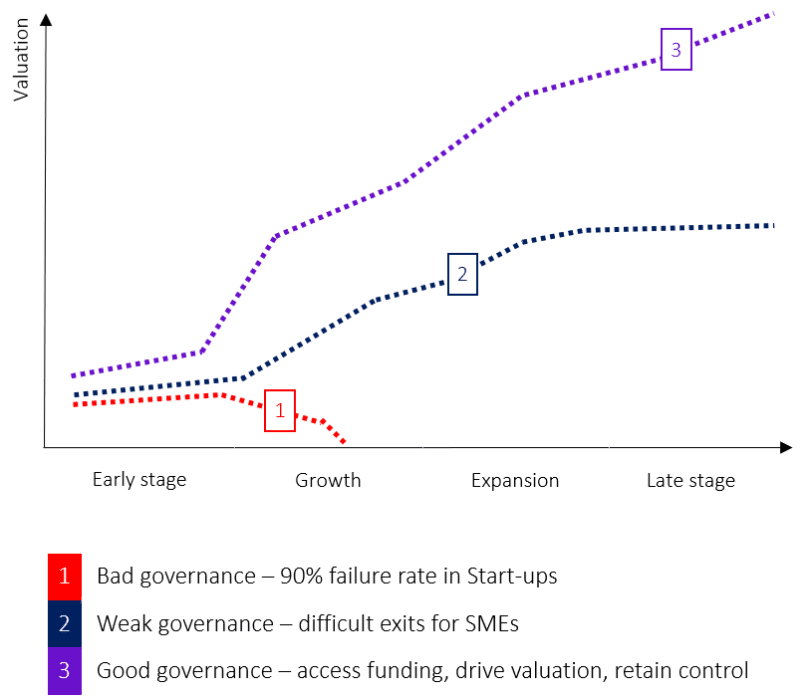

Start-ups faced a failure rate of 90% before COVID-19 shocked our socio-economic structures. Now, good corporate governance (CG) practices offer start-ups a much-needed lifeline. Consistent corporate governance practices build sustainable profitability and strong investor relations.

Why ESG is Important for Companies?

ESG stands for Environmental, Social, and Governance and it speaks to the sustainability and social impact of an entity. ESG emerged as a top investment trend over the past decade but reached its boiling point over the past year. While these might sound like buzzwords to some, ESG has been tied to positive financial performance in a review of over 2000 empirical studies in the Journal of Sustainable Finance & Investment.

Whilst the Environmental and Social components of ESG have attracted headlines, it’s becoming increasingly clear that E and S are a function of G. MSCI reports that when isolating the three variables, governance has the strongest correlation to profitability. Investors favor the sustainable profitability that good governance delivers, in turn creating firepower for good corporate deeds.

What Is Good Corporate Governance?

It’s a fatal mistake to view corporate governance as simply a series of admin exercises in company management, pay, internal controls and behaviours. Good governance works to ensure that decisions support the long-term sustainability of a company in measurable ways. Good governance is a commitment impacting “cash-flow, idiosyncratic risk and valuation channels” according to MSCI, concerns shared by start-up founders and their investors.

Why Start-ups Fail?

Young companies must overcome short-term volatility to enjoy the long-term benefits of ESG. For start-ups with short runways, poor governance means almost certain death. Here are the facts:

- 90% of start-ups will fail.

- 75% of venture-backed start-ups will fail.

- More than 50% of start-ups will die before their fifth year.

Let’s look at some of the reasons start-ups reported as reasons for failure:

- Ran out of cash (29%).

- Not the right team (23%).

- Disharmony with investors (13%).

- Lost focus (13%).

- Didn’t use available network/advisors (8%).

- Legal challenges (8%).

While many start-ups fail because they simply do not have good ideas, a majority of start-ups have good ideas but lose focus, run into red tape, or simply run out of runway. This is why corporate governance matters for start-ups. Good governance helps you avoid these pitfalls by clarifying your focus, measuring progress, and maximizing your investorrelations. When you almost inevitably run out of runway and need more cash, good investor relations will help you access additional funding.

But isn’t CG expensive and time-consuming?

Yes, generally speaking, you need specialist staff and enabling technologies. There are usually only two options when it comes to CG:

- Founders outsource governance, which is expensive and leads to slower, disconnected results.

- Founders take the lead on governance but are forced to connect the dots.

But doing nothing is not an option. In the competitive world of start-ups, you must communicate with your investors clearly and consistently. So, what’s the third option?

Corporate Governance as a Service

Eurostep Digital help you build world-class corporate governance practices through a secure platform. This approach builds and streamlines the most vital component of ESG.

| Company Information | Corporate Actions | INED | Governance Rating |

|---|---|---|---|

| Issue Newsletters, IR Releases and presentations monthly or on-demand with templates that are ready to go | Manage capital events and corporate actions, time-stamped by the Blockchain to meet shareholder requirements. | Access expert advice or appoint INEDs to your board for active engagement in corporate governance execution | Demonstrate tangible ESG credentials, access funding and maintain investor confidence |

What are the Benefits of Corporate Governance?

Streamline your governance practices with a ready-to-go platform. Instantly engage in a comprehensive approach that centralizes the communication between you and your investors. Remove the need for ad-hoc solutions and build investor relationships that will pay dividends for years to come.

Key takeaways:

- Start-ups need strong ESG credentials to attract investors and keep them investing.

- Good governance will demonstrate your ESG credentials and build strong investor relations.

- Eurostep Digital offers Corporate Governance as a Service.

Corporate governance isn’t something you can do last minute. Most start-ups don’t have the luxury of time. Even if you don’t establish CG through Eurostep Digital, you will need a governance strategy to keep yourself on track and investors confident.

The good news is that governance is the most important aspect of ESG when it comes to your company’s profitability and sustainability and it’s the component that you have the most control over. As an entrepreneur, you know that disruption brings opportunity. The rapidly changing socio-economic landscape will reward those with the ability to endure.

Sign up today to try corporate governance as a service. Risk-free.