In Part 1 of Why iNEDs Matter, we discussed the unique attributes that an iNED brings to a board of directors. Boards with these attributes produce a range of benefits for management and shareholders Improved Decision-making The contributions of iNEDs … Read More

Corporate Governance

Why iNEDS Matter: Part 1 – Defining iNEDs

What is an iNED? iNED stands for independent, non-executive director. You will often find them referred to as independent directors or non-executive directors (NEDs). Aon.com defines iNED as, an individual who is a director (member) of the board of directors … Read More

PE Funds: Strengthen these relationships to maximize value

Private Equity funds will need to strengthen relationships with three key stakeholder groups to realize and sustain their full potential: portfolio companies, limited partners, and their own workforces. Challenges to Private Equity Model Private equity continues to grow, but not … Read More

What Limited Partners Want

Limited Partners have expressed the need for change for years but progress has been slow due to the nature of traditional, paper-driven reporting. Digital innovation removes these limitations and creates new opportunities. How GPs of Private Equity Funds Can Deliver … Read More

Family Firms – Top Three Research Papers

Corporate governance and ESG are fast-evolving topics and it’s easy to fall behind on research. Our team analyzed 20 working papers published on ECGI’s website and found these three to be the most informative and engaging. Did “ESG” Firms Perform … Read More

Do Governments Make Good Venture Capital Investors?

The EC is to become a direct investor in start-ups. A new source of venture capital is welcome but do founders want the government in their capital table? … Read More

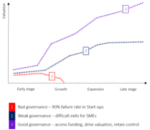

Why Corporate Governance Matters for Start-ups

Start-ups faced a failure rate of 90% before COVID-19 shocked our socio-economic structures. Now, good corporate governance (CG) practices offer start-ups a much-needed lifeline. … Read More